Context: In February, Judges Terrence Boyle of the United States District Court for the Eastern District of North Carolina denied an antisuit injunction motion by Lenovo and its Motorola Mobility subsidiary that would have barred Ericsson from the enforcement of various Latin American standard-essential patent (SEP) injunctions (February 15, 2024 ip fray article). Lenovo appealed that decision to the Federal Circuit and requested an expedited appeal. ip fray reported on the appeal and the scheduling discussion primarily on LinkedIn and by email (you can subscribe in the right-hand column of the home page), but also in a March 12, 2024 article.

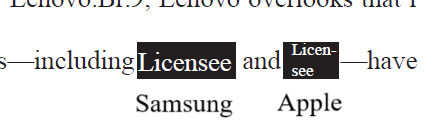

What’s new: On Wednesday (May 1, 2024), Ericsson filed its responsive brief (the only brief it gets to file as appellee, unless the exceptional circumstances for allowing a sur-reply were met later). There are some interesting statements in that filing, particularly that Ericsson says “other phone makers” (whose names are redacted, but might include Samsung and Apple) have agreed to pay Ericsson 5G SEP royalties amounting to 1% of a phone’s selling price, capped at $4 per unit. Presumably there are, however, major deductions due to cross-licenses and possibly discounts.

Direct impact: The relevance of that information to the Lenovo v. Ericsson antisuit appeal is simply that if Ericsson succeeded in having the same royalty rate blessed by a North Carolina jury, Lenovo would not be prepared to take a global SEP license that would be dispositive of Ericsson’s Latin American enforcement. But U.S. antisuit injunctions issue only if a U.S. litigation will dispose of foreign actions. By pointing to the fact that the license agreements with some other phone makers support Ericsson’s proposed royalty rate, and by furthermore noting that a Texas jury and the Fifth Circuit deemed that 5G rate “acceptable “FRAND even for Ericsson’s less-advanced 4G technology” (emphasis in original), Ericsson wants to show that it may very well prevail on this question, and in that not-unlikely scenario, the North Carolina action, due to Lenovo’s refusal to take a license on those terms, would not resolve the global dispute.

Wider ramifications: There are other interesting pieces of information in Ericsson’s appellate brief, and they relate to Lenovo’s strategy of seeking to duck not only the Latin American enforcement actions but also the U.S. litigation. Practically speaking, Lenovo’s preferred jurisdictions is the UK, as ip fray has repeatedly noted. Ericsson’s appellate brief reveals how far Lenovo has already gone to get rid of the U.S. litigation in which it is now seeking an antisuit injunction. The brief also reveals interesting facts about Lenovo’s stalling during licensing negotiations as well as in litigation, particularly with respect to its own Brazilian appeal. ip fray will discuss those issues in a separate article that will also take a look at Lenovo’s tactics in the dispute with another major net licensor of SEPs, InterDigital (May 3, 2024 ip fray article).

First, here’s Ericsson’s lengthy filing, which makes strong points but is annoyingly repetitive, raising some the very same arguments not only once or twice but multiple times throughout the document:

Here’ are’s a screenshot of where Ericsson says the 1%/$4 max royalty rate for 5G SEPs is paid by “other phone makers”:

The redacted names could be Samsung and Apple. Those are the two major phone makers with whom Ericsson was embroiled in shortlived litigation in recent years, but then signed 5G patent license agreements. The width of the redacted passages makes Samsung very likely. Apple is a possibility, too:

The court filing also mentions on a couple of other occasions the fact that the rate has a significant degree of market acceptance. For instance, “[Lenovo] would simply be accepting the same rate other smartphone manufacturers already pay and U.S. courts have already found to be FRAND—hardly an inequitable hardship.”

Both Samsung and Apple (should they be the ones Ericsson elected to name, which would obviously make sense as they are the two most important ones, particularly in the U.S.) hold many SEPs and non-SEPs of their own. Ericsson makes mobile base stations and therefore needs a cross-license. If Apple paid that rate, it would be $4 per iPhone or cellular iPad, as there is no Apple product with cellular connectivity below a selling price of $400. Apple makes a quarter billion iPhones alone per year. That would mean roughly a billion dollars in SEP royalties to Ericsson per year just for iPhones and cellular iPads. Obviously that is not what Ericsson receives on the bottom line. But it could be that the headline royalty rate in the Samsung and Apple agreements (as well as in various others) is indeed that one, just that those licenses are often a two-way street and what Ericsson ultimately gets is the balance. Moreover, it is possible that those agreements also involved substantial discounts (volume, long-term contracts, possible upfront payments etc.).

Ericsson would not tell a U.S. court that other phone makers have accepted that rate if it wasn’t true. It’s just that the whole truth will inevitably also involve cross-licenses and potentially discounts.

Rarely do court filings make a SEP holder’s position on the correct royalty rate as clear as Ericsson’s appellate brief in the antisuit dispute with Lenovo.